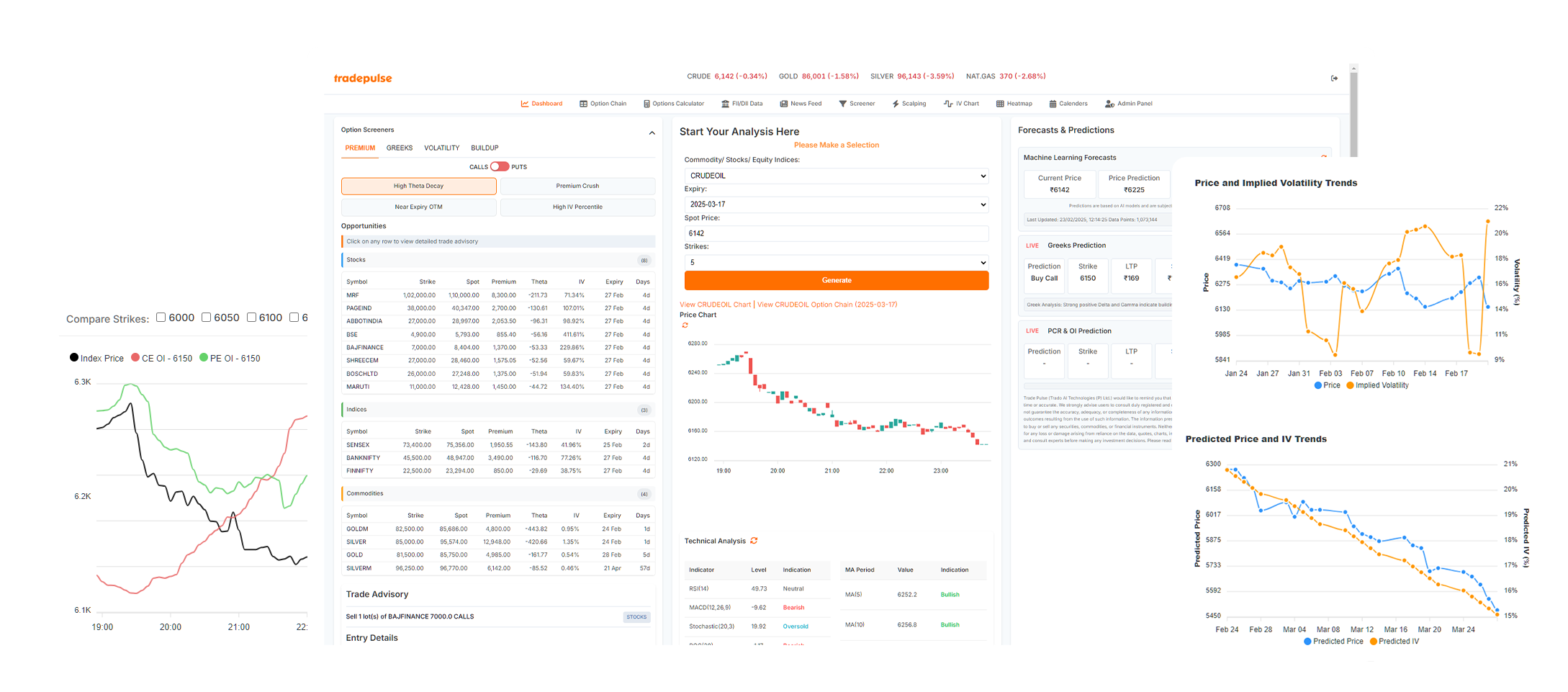

TradePulse – AI-Powered Market Analytics Platform

TradePulse is your market intelligence center. Built for precision, powered by artificial intelligence, and designed to decode the noise of commodities and derivatives markets. Advanced data visualization and analysis tools for informed decision-making.

Explore Market Analytics

🔥 AI-Powered Market Intelligence

TradePulse is your gateway to institutional-grade market insights for commodities, indices, and stock derivatives. Advanced analytical tools that bring professional-level research and data analysis within reach.

With intelligent data visualization, real-time analytics, and seamless user experience, TradePulse provides clarity and depth for comprehensive market understanding.

Core Technologies & Capabilities

AI-Powered Option Chain Analysis

Real-time processing of option chain data, revealing hidden patterns and market structures.

- Live monitoring of every strike, expiry, and tick

- Market structure analysis with AI models

- Volatility shift detection with signal overlays

- OI heatmap visualization for quick insights

Analytics Edge: Comprehensive institutional money flow analysis.

Market Intelligence Engine

Data transformed into actionable insights with adaptive AI algorithms.

- High-precision directional bias detection

- Short-term trend analysis from live signals

- Volume/OI behavior segmentation analysis

- Early anomaly identification in market data

Analytics Edge: Intelligence-driven market insights and analysis.

Time-Series Pattern Analysis

Advanced charting and pattern recognition for market analysis.

- High-frequency candlestick aggregation

- OI flow alignment reveals accumulation patterns

- Dynamic indicators tuned to asset volatility

- Smart time synchronization for market sessions

Analytics Edge: Clean signals and comprehensive pattern recognition.

Options Volatility Analysis

Deep insights into option behavior, Greeks, and time decay patterns.

- Live option valuation with decay trajectory visualization

- Interactive Greek curves across expiries

- Spot/premium divergence volatility monitoring

- Integrated margin calculators for position sizing research

Analytics Edge: Advanced theta decay visualization and analysis.

Secure Access Control

Enterprise-grade security and user management for your research team.

- Tiered access control for roles/permissions

- Token-secured invitation onboarding

- Live session monitoring with override options

- Comprehensive audit logs for compliance

Analytics Edge: Total control for solo researchers or teams.

Options Strategy Analyzer

Analyze and visualize options strategies with advanced modeling tools.

- Smart symbol search with auto-suggestions

- Instant market parameters for analysis inputs

- Visual risk-reward with max loss/gain calculation

- Integrated OI and premium data visualization

Analytics Edge: Scientific approach to options strategy research.

News & Sentiment Analysis

Connect fundamental news with technical patterns using AI-powered sentiment analysis.

- Instrument-specific curated news feed

- Market mood analysis with sentiment overlays

- Commodity forecast research dashboards

- Social media sentiment parsing capabilities

Analytics Edge: Understand market sentiment beyond price action.

Professional Research Dashboards

Complete analytics center for serious market researchers and analysts.

- Real-time heatmaps for OI and price analysis

- Time-based chain analysis with historical data

- Basis tracking with intermarket relationships

- Specialized analytical tools for various timeframes

Analytics Edge: Comprehensive market research and monitoring.

Advanced Analytics Features

Discover the comprehensive suite of analytical tools for market research

Option Screeners

Discover market opportunities with AI-powered option screening and filtering tools.

Market Trend Analysis

Access real-time market trend analytics and pattern recognition for all asset classes.

Machine Learning Pattern Recognition

Harness machine learning models for historical market pattern analysis and studies.

Greeks Monitoring & Analysis

Monitor and analyze options Greeks like Delta, Gamma, and Vega using advanced AI models.

PCR & OI Analysis

Gain insights on put-call ratios and open interest patterns for market research.

Technical Analysis

Automatically detect support, resistance, and chart patterns across multiple timeframes.

Volatility Cone Analysis

Analyze the range of potential volatility outcomes with advanced cone analysis.

Risk Simulation (Monte Carlo)

Simulate various market scenarios for comprehensive risk assessment and research.

Anomaly Detection

Spot unusual market activities using AI-powered anomaly detection algorithms.

Open Interest Monitoring

Visualize and analyze open interest data with dynamic heatmaps and charts.

Options Liquidity Analysis

Detect demand-supply zones and liquidity patterns in real-time.

Market Regime Detection

Identify shifts in market conditions for better strategy adaptation.

How TradePulse Compares

A quick snapshot of where TradePulse stands versus other popular analytical platforms in the Indian market. Focused on comprehensive market research and data analysis capabilities.

| Area / Feature | TradePulse TP | Quantsapp QA | Sensibull SB | Stoxo SX | Shoonya (AI) SH |

|---|---|---|---|---|---|

| Market Coverage | |||||

| Equity analytics (NSE/BSE) | ✓ | – | ◐ | ✓ | ✓ |

| Indices analytics (Nifty, BankNifty, etc.) | ✓ | ✓ | ✓ | ✓ | ◐ |

| Commodities (MCX) analytics | ✓ | – | – | – | – |

| Derivatives & F&O Analytics | |||||

| Full option chain analysis (indices + stocks) | ✓ | ✓ | ✓ | – | – |

| Greeks, OI, IV, PCR, F&O heatmaps | ✓ | ✓ | ✓ | – | – |

| Options strategy analyzer | ✓ | ✓ | ✓ | – | – |

| SPAN margin calculators (stocks / indices / MCX) | ✓ | – | – | – | – |

| AI / Machine Learning | |||||

| ML Trend Analysys (LSTM / Prophet) | ✓ | – | – | ✓ | ✓ |

| News & sentiment analysis (FinBERT / NLP) | ✓ | – | – | ◐ | – |

| Dedicated AI research assistant | ◐ | – | – | ✓ | – |

| Multi-timeframe ML analytics models | ✓ | – | – | – | – |

| Risk & Market Regime | |||||

| Risk simulation (Monte Carlo scenarios) | ✓ | – | – | – | – |

| Time-based OI / option-chain historical data | ✓ | ✓ | ✓ | – | – |

| Market regime & sentiment dashboards | ✓ | ◐ | ◐ | ✓ | ◐ |

| Platform & Analytics Tools | |||||

| Market screeners (equity / F&O) | ✓ | ◐ | ✓ | ◐ | – |

| Portfolio analysis & research dashboards | ✓ | – | ✓ | ◐ | ✓ |

| Data export & API integration | ✓ | – | ✓ | – | ✓ |

| Role-based access & multi-user RBAC | ✓ | – | – | – | – |

*Comparison is focused on Indian markets and on features publicly available or documented. TradePulse combines multi-asset coverage, deep F&O analytics, and ML + risk analysis engines in a single research platform.

*Disclaimer: Competitor feature availability is based on publicly available information. All trademarks and product names belong to their respective owners. No endorsement or affiliation is implied.*